Saving vs. Investing: A Path to Growing Investor’s Wealth Safely

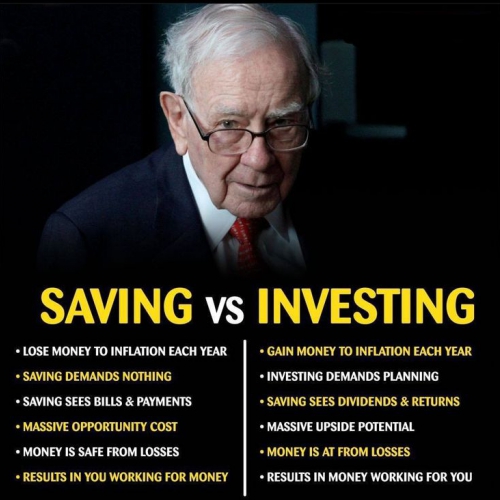

Building and growing wealth is a goal shared by many, and it’s essential to understand the difference between saving and investing to chart a clear path toward financial prosperity. In this blog, let’s explore the key distinctions between these two approaches and outline a strategy for combining them to achieve one’s financial goals safely.

Savings: The Foundation of Financial Security

* Savings provide a safety net; offer financial security during emergencies or unexpected expenses. Here’s why savings matter:

1. Liquidity: Savings are easily accessible, providing quick access to cash when needed.

2. Security: Money saved in a bank account or other low-risk options is protected from market fluctuations.

3. Short-Term Goals: Savings are suitable for short-term financial goals, like an emergency fund or upcoming vacation.

4. Peace of Mind: Knowing one has savings can reduce stress and anxiety about unexpected expenses.

Investing: A Way to Generate Wealth

* Investing involves putting one’s money to work with the expectation of earning a return, it helps in growing wealth over time. Here’s why investing is considered crucial for long-term wealth growth:

1. Potential for Higher Returns: Investing in assets like stocks, bonds, and real estate has the potential to generate higher returns compared to traditional savings accounts.

2. Beat Inflation: Investing over long term helps your money grow more than the rate of inflation, preserving its purchasing power over time.

3. Achieving Long-Term Goals: Investing is ideal for long-term financial objectives, such as retirement or purchasing a home.

4. Diversification: Properly diversified investment portfolios spread risk and can be less volatile than individual assets.

Diversification ensures investor’s wealth is hedged and is available in any market environment.

The Path to Grow Wealth Safely

* To grow investor’s wealth safely, it’s vital to strike a balance between saving and investing. Here’s a step-by-step approach to consider:

1. Build an Emergency Fund: Start by saving enough to cover 3-6 months of living expenses. This will protect one from unexpected financial setbacks.

2. Pay Off High-Interest Debt: Before investing, eliminate high-interest debts, such as credit card balances, personal loans, etc. This ensures one isn’t paying more in interest than they are earning through investments.

3. Set Clear Goals: Investors must define their financial objectives, both short-term and long-term. This will guide their saving and investing strategies. Once a clear strategy is formed an investor should be disciplined on that journey.

4. Save Consistently: Investors must continue to save a portion of their income, even as one begins investing. This provides a safety net and ensures one can take advantage of investment opportunities.

5. Invest Wisely: Investors must research and choose investment options that align with their risk tolerance and goals. One must diversify their portfolio to spread risk.

6. Reinvest Returns: As one’s investments generate returns, reinvesting them is important to harness the power of compounding and accelerate wealth growth.

7. Review and Adjust: Investors should regularly review their financial plans and make adjustments accordingly as one’s goals and risk tolerance may change over time.

* Conclusion: Savings and investing are complementary strategies that, when used together, can help investors grow their wealth safely. By building a foundation of savings, paying off high-interest debt, and wisely investing in assets that matches one’s financial goals, one can chart a clear path to financial prosperity. Remember that the key to financial success is patience, discipline, and continuous learning.